Getting the Most out of Xero Tracking Categories

Do you ever look at your business and wish that you could tell which areas were most profitable and which ones probably need a bit or work? Well with tracking categories in Xero you can do just that! Knowing exactly which areas of your business income is coming from, and just as importantly where you’re spending money, enables you to make proactive business decisions.

Meet Clara

Clara is a graphic designer, offering design, branding, website creation, and website maintenance. Clara’s working at full capacity (way to go Clara!) and now wants to see exactly how her income is coming in. She really enjoys building websites and so really pushes this side of her business in her marketing.

All in one pot

The simplest way of recording sales is to put everything under one income account. This is fine if all you want to do is to see your total income, but once you start wanting to be drill down deeper into how your business is performing you may well find that you want to be able to see how this is broken down. You could create a separate sales account for each of the areas you deal with, but if you also want to be able to see the breakdown of your expenses you’re very quickly going to end up with an unwieldy list of accounts. In my experience the longer a list of accounts to choose from, the more likely it is that there’ll be errors, which kind of makes the whole thing a bit pointless really!

Breaking it down

You can have up to two tracking categories in Xero, each with up to 100 options, which will be more than enough for most small businesses. You might want to track different service offerings, like Clara, possibly also adding in individual projects. Or perhaps you run a small coffee shop chain and want to measure the performance of each location. Whatever your business, using tracking categories will help you learn much more about it.

Using tracking in practice

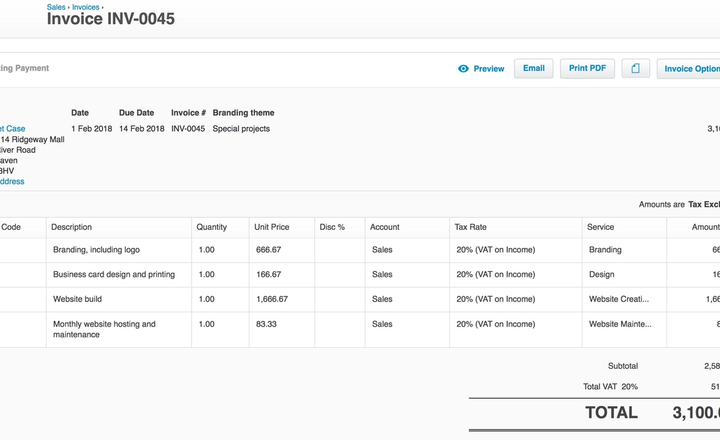

Once your tracking categories have been set up (by going to General Settings and Tracking), you’ll see that you now have an action column when adding sales invoices or purchases, so that you can tell Xero how each item should be treated. In the image below we can see how an invoice from Clara to one of her clients might look.\

Reports

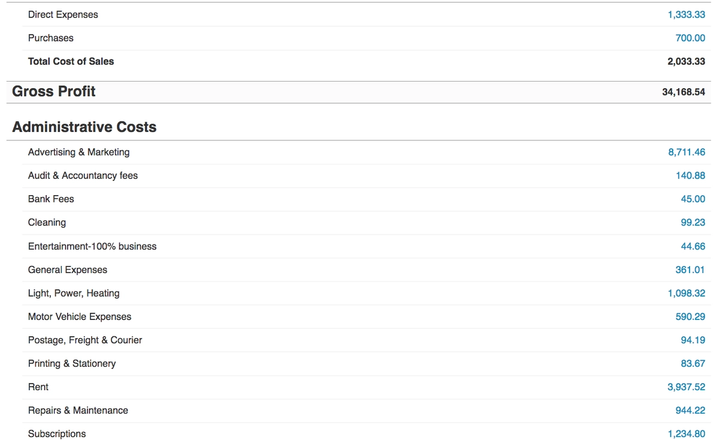

Now we’re splitting out her income and expenses into her different service offerings, we can start filtering the reports in different ways so that we get a full picture of how Clara’s business is doing.

When we look at her overall profit and loss account things look pretty good and she’s making a nice profit.

But if we filter the report so we’re only looking at the Website Creation service, we can see that so far this year she’s spent more in advertising this than she’s made from actually selling it! This doesn’t necessarily mean that she needs to make any major decisions about it just yet, but it highlights that this area of her business is currently loss-making and so should be monitored.

Keep on trackin’

I often bang the “know your numbers” drum as it will really help you to build a successful business. But although you need to look at the big picture, it’s just as important to drill down into the detail to make sure that all of your efforts are being rewarded, or that if you have a particular service making a loss that this is something you’re happy with.

Xero’s tracking categories can be used in so many ways, I’d love to hear from you about how you’re using them in your business.